Understanding the Alligator Indicator

The Alligator Indicator, developed by the renowned trader Bill Williams, is a technical analysis tool designed to identify market trends and potential reversals. It comprises three essential components: the Jaw, the Teeth, and the Lips, each represented by a moving average with distinct periods. These three lines interact to provide traders with clear signals about the market’s direction and momentum.

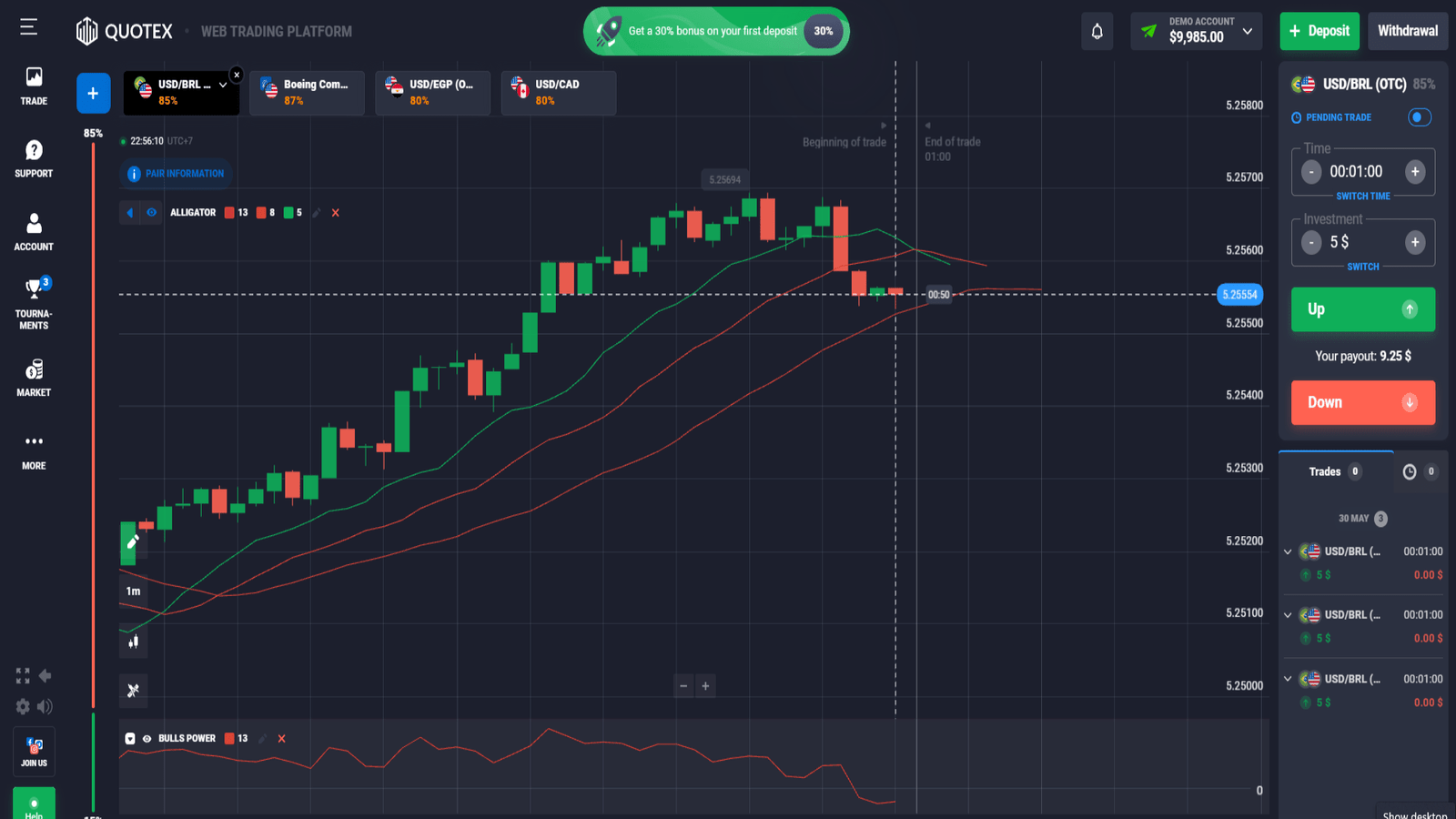

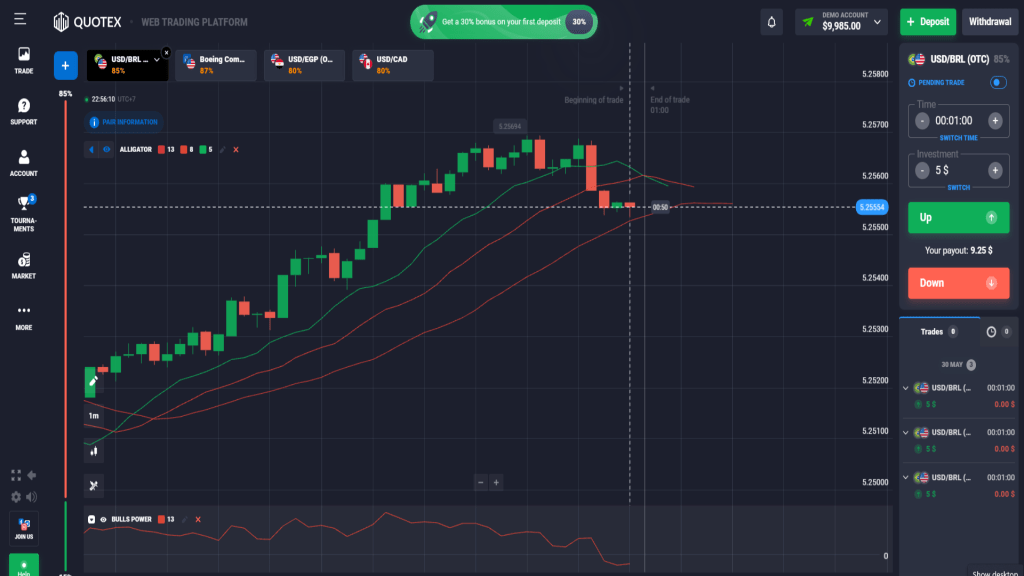

The Jaw, typically set with a 13-period smoothed moving average, is the slowest of the three lines and is often colored blue. It reflects the longer-term market trend and acts as a foundational guide. The Teeth, represented by an 8-period smoothed moving average and usually colored red, offer a mid-term perspective and are more responsive to price changes. Finally, the Lips, the fastest line with a 5-period smoothed moving average and often colored green, capture the short-term trend and are the first to react to market fluctuations.

The interaction among these three lines is critical for interpreting the Alligator Indicator. When the Jaw, Teeth, and Lips are intertwined or close together, the Alligator is considered to be “sleeping,” indicating a period of market consolidation or lack of a clear trend. As the lines begin to separate and align in a specific direction, the Alligator “awakens,” signifying the start of a new trend. If the green Lips line crosses above the red Teeth and blue Jaw lines, it signals a potential bullish trend. Conversely, if the Lips cross below the Teeth and Jaw, it suggests a bearish trend.

The name ‘Alligator’ reflects the behavior of the indicator’s lines, which mimic the opening and closing of an alligator’s mouth. This visualization helps traders understand the periods of market inactivity (when the Alligator sleeps) and the moments when the market trends strongly (when the Alligator awakens and feeds).

By grasping the theoretical foundation and operational mechanics of the Alligator Indicator, traders can better anticipate market movements and make more informed trading decisions. Understanding this tool is crucial before applying it in a practical trading scenario on platforms like Quotex.

Setting Up the Alligator Indicator on Quotex

To begin trading on Quotex using the Alligator Indicator, the first step is to log into your Quotex account. If you do not already have an account, you will need to sign up and complete any necessary verification processes. Once logged in, navigate to the trading interface where your charts are displayed.

On the trading interface, you will find a menu or toolbar that includes various chart settings and tools. Look for the ‘Indicators’ option, which is typically represented by an icon that resembles a bar chart or a similar visual cue. Click on this icon to open the list of available technical analysis tools.

In the list of indicators, scroll until you find the ‘Alligator Indicator.’ Click on it to add it to your chart. The Alligator Indicator is composed of three lines, each representing different moving averages: the Jaw, the Teeth, and the Lips. These lines help traders identify market trends and potential entry points.

Once the Alligator Indicator is added to your chart, you can customize its settings to better suit your trading strategy. To do this, click on the settings icon next to the indicator. A customization menu will appear, allowing you to adjust the periods for the Jaw, Teeth, and Lips. The default settings are typically 13, 8, and 5 periods, respectively, but you can modify these values based on your analysis and trading preferences.

For instance, if you prefer to trade on shorter timeframes, you might reduce the periods to increase the sensitivity of the indicator. Conversely, for longer-term trading, you might choose to lengthen the periods for a more stable signal. Additionally, you can change the colors and thickness of the lines to enhance visibility according to your personal preference.

To ensure you are making the most of the Alligator Indicator, it is advisable to backtest your customization settings on historical data. This practice helps you understand how the indicator performs under various market conditions and refine your strategy accordingly.

By following these steps, you can effectively set up and customize the Alligator Indicator on Quotex, enabling you to make more informed trading decisions.

Interpreting Alligator Indicator Signals

The Alligator Indicator, developed by Bill Williams, is a popular technical analysis tool that can help traders identify market trends and make informed trading decisions on platforms like Quotex. Understanding how to interpret its signals is crucial for leveraging its potential effectively.

The Alligator Indicator consists of three lines: the Jaw (blue), the Teeth (red), and the Lips (green). These lines represent moving averages with different periods, and their interactions can provide insightful signals about the market’s direction.

When the Alligator ‘sleeps,’ the three lines are close together, indicating a period of low volatility and a sideways market. During this phase, it is often prudent for traders to wait, as the market lacks a clear direction. Conversely, when the Alligator ‘wakes up’ and the lines begin to spread apart, it signifies an increase in market volatility, signaling the start of a new trend. This phase is characterized by the Jaw, Teeth, and Lips moving away from each other, indicating that the market is gaining momentum.

A bullish trend is suggested when the green Lips line crosses above the red Teeth and blue Jaw lines, with all lines subsequently spreading apart. This scenario implies that buyers are gaining control, and prices are likely to rise. On the other hand, a bearish trend is indicated when the green Lips line crosses below the red Teeth and blue Jaw lines, followed by all lines diverging. This suggests that sellers are dominating the market, potentially leading to declining prices.

To enhance your understanding of these signals, it is beneficial to study practical examples and historical data available on the Quotex platform. By analyzing past market behavior in different scenarios, traders can gain confidence in recognizing and interpreting the Alligator Indicator’s signals. Such practice helps in making more informed and timely trading decisions.

Ultimately, mastering the interpretation of the Alligator Indicator on Quotex can significantly improve one’s trading strategy, leading to better anticipation of market trends and more profitable outcomes.

Developing a Trading Strategy with the Alligator Indicator

Creating an effective trading strategy using the Alligator Indicator on Quotex involves a blend of technical analysis and risk management. The Alligator Indicator, developed by Bill Williams, helps traders identify market trends and potential reversals by using three moving averages: the Jaw (blue), the Teeth (red), and the Lips (green). To optimize its effectiveness, combining the Alligator Indicator with other technical analysis tools such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can enhance the accuracy of your trades.

For instance, when the Alligator’s Jaw, Teeth, and Lips are aligned and moving in the same direction, it indicates a trending market. To confirm this trend, traders can use the RSI to check for overbought or oversold conditions or the MACD to spot momentum shifts. When the Alligator lines converge, it signals a period of consolidation, suggesting it’s time to wait for a clear breakout before entering a trade.

Risk management is crucial in trading, especially when using indicators. Setting stop-loss and take-profit levels can protect your capital and lock in profits.

A stop-loss order can be placed just below the recent swing low for long positions or above the recent swing high for short positions. Meanwhile, take-profit levels can be set based on anticipated market movements or key resistance/support levels.

Backtesting your strategy using historical data on Quotex is another essential step. This involves applying your strategy to past market conditions to evaluate its effectiveness. Quotex provides historical data, allowing traders to simulate trades and refine their approach before committing real capital.

Real-world examples can illustrate the practical application of these strategies. For instance, during a trending market, aligning the Alligator Indicator with the RSI confirmed an upward trend, leading to a profitable long position. Conversely, during a consolidation phase, the Alligator and MACD indicated a potential breakout, resulting in a successful short trade.

By combining the Alligator Indicator with other technical tools, employing sound risk management techniques, and backtesting strategies, traders can enhance their trading performance on Quotex.